Are you wondering how accountants make money? Whether you’re looking to switch careers or become an accountant, understanding the average salary will help you make informed decisions.

Many people believe accounting is simply about crunching numbers and filing taxes. But honestly, it’s more than that.

The way accountants build income is tied to their education, effort, services, and the relationships they nurture over time.

Let’s break it down into simple words.

How Do Accountants Make Money, and What’s the Average Salary?

If you are seeking a stable career with job security and an excellent salary, accounting is in high demand. They make good money. In this guide, we will answer your question: how do accountants make money and what factors influence their income? Let’s dive in!

If you are seeking a stable career with job security and an excellent salary, accounting is in high demand. They make good money.

In this guide, we will answer your question: how do accountants make money and what factors influence their income? Let’s dive in!

The Education and Effort Behind It

Becoming an accountant isn’t quick. You study for years, pass exams, and then consider certifications like CPA, ACCA, or CMA, depending on your country.

That knowledge doesn’t just teach you numbers, it builds problem-solving skills. You learn discipline, communication, and research methods.

The effort doesn’t stop after school. Every year, there are changes in tax laws, new accounting standards, and financial tech tools. You need work experience with CPA firms for at least 3 years and keep learning just to stay sharp and relevant.

Take Sandipan Paul, the founder of HireNCS, for example. He holds a degree in Applied Accounting from Oxford Brookes University and is ACCA qualified.

Starting as a freelance accountant, he worked with top CPAs and businesses across multiple industries.

Over 13 years, he expanded his expertise to help entrepreneurs with their accounting back-office needs. That’s a clear story of education and ongoing effort turning into real-world success.

Pro Tip: The more you specialize (in international taxation, audit, or forensic accounting, the more you can charge clients.

Primary Ways Accountants Make Money

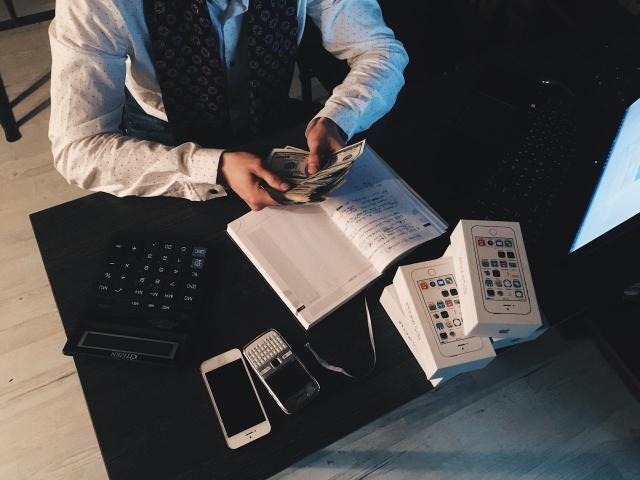

Accountants primarily earn money by offering their specialized skills and professional services to clients.

They charge fees for tasks like auditing financial records, preparing tax returns, advising on financial strategies, and managing bookkeeping.

These core services are the primary income sources that leverage their expertise to solve client problems and help businesses stay compliant and profitable.

- Bookkeeping: Keeping client records tidy, simple, and compliant. It’s a recurring income each month.

- Tax Preparation Services: Filing returns for individuals and businesses. Seasonal but profitable.

- Auditing: Reviewing financials to ensure everything checks out. Bigger companies pay a lot here.

- Consulting: Advising businesses on cash flow, growth plans, and increasing profits.

- Payroll Services: Handling salaries, deductions, and benefits for companies.

- Financial Planning: Helping individuals and organizations forecast and manage their finances wisely.

When you look closer, every service builds on trust. That’s why referrals and relationships are golden.

Knowledge Gained After Working with Clients

Accountants don’t just sell number skills. After a while, you start picking up industry knowledge too.

- Doctors and clinics? You understand billing issues.

- Construction firms? You learn how projects handle budgets.

- Startups? You see how raising investments works.

- Real estate clients? You know everything about property taxes, deductions, and regulations.

This knowledge turns into advice. And advice is where higher income lives.

Teamwork, Investment, and Tech Usage

No successful accountant works alone forever. You build a team, train them, and share the load. That’s how you scale from one client to fifty.

Also, smart accountants invest in tools. Cloud accounting software, payroll automation, expense trackers—they cut hours of manual work. The less time spent, the more clients served.

Pro Tip: Never see software as a cost. It’s an investment that multiplies your earning potential.

The Value of Soft Skills

The truth is that numbers alone won’t make you money. Communication skills matter. You explain complex financial things in simple words, so clients don’t feel lost.

Management skills matter. You set deadlines, keep clients happy, and balance teams.

Trust + clarity = clients staying for years. And long-term clients are always more profitable than one-off ones.

Co-Founder & CEO Sandipan Paul’s Approach to Client Retention:

I believe in proactive communication with clients, holding monthly meetings, and ensuring timely report submissions. I also follow up regularly, provide 24/7 responses to emails and messages, and offer quick solutions to any challenges.

Additionally, I maintain informal communication, provide in-depth business follow-ups, and always prioritize problem-solving to keep clients satisfied and engaged.

How Much Do Accountants Make?

The answer depends on many factors, such as experience, education, location, and industry specialization.

In the United States, the average accountant’s salary in 2025 ranges around:

- $70,000 per year according to Glassdoor

- $65,000 per year on Indeed

- $68,000 per year reported by PayScale

The U.S. Bureau of Labor Statistics reports a median annual wage of $81,680 for accountants and auditors, with entry-level salaries starting closer to $52,000 and top earners making over $140,000 annually.

Salaries tend to be higher in major metropolitan areas and for accountants with certifications like CPA or specialized expertise.

Factors Influencing Accounting Income

- Professional Credentials: Achieving certifications such as a CPA significantly boosts your earning potential by validating your expertise and unlocking advanced career opportunities.

- Work Experience: Accountants with more years in the field, especially those in supervisory or managerial roles, generally earn higher pay.

- Specialized Services: Offering in-demand and complex services like cybersecurity audits or advanced tax strategies can lead to premium compensation.

Expertise matters in the accounting world. At HireNCS, we have over a decade of experience in providing specialized accounting services for various industries. We worked with 500+ SMBs and completed 200K+ hours. Check our “About Us” page for more details.

Steps to Grow Your Income as an Accountant

- Begin with broad services such as taxes and bookkeeping.

- Pick a niche you enjoy, like real estate, IT, or restaurants.

- Keep updating skills with new certifications.

- Build a small team when you feel overloaded.

- Use tech tools for efficiency.

- Market yourself—website, SEO blogs, LinkedIn posts.

- Treat clients like partners, not just transactions.

Final Thoughts

Accountants make money by mixing education, years of work experience, services, teamwork, and innovative use of tools. It’s a blend of technical accounting and human-centered skills, such as communication and management.

At the end of the day, accountants are not just “balancing books.” They are helping people and businesses grow. That’s why people are willing to pay good money for their expertise.